Pnb Interest Rates

- Fixed deposit premature withdrawal & applicable Interest Rates. PNB Housing provides for the provision of premature cancellation of your Fixed deposit. There is a compulsory lock-in for 3 months, after which the fixed deposit can be withdrawn. However, the interest rate charged would be lower than the initial agreed about FD interest rate.

- Gold Loan Interest Rates: Compare cheapest Gold Loan Rates or ornaments/jewellery by Various Bank SBI, Muthoot, Mannappuram, HDFC, ICICI, PNB, Axis banks etc.

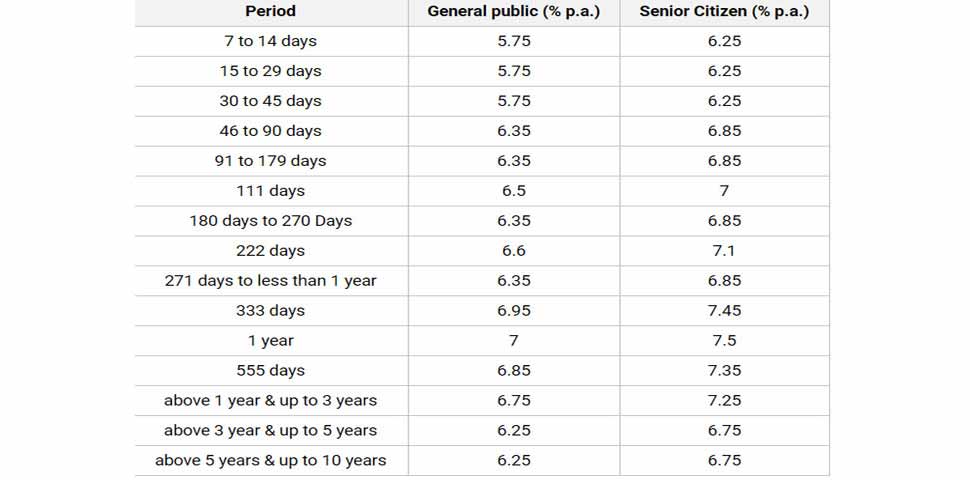

- Pnb Interest Rates On Fixed Deposits

- Pnb Interest Rates On Loans

- Pnb Interest Rates On Savings Account

FD interest rates in IDFC First Bank range from 2.75%p.a. For deposits with a tenure of 7 days to ten years.State Bank of India (SBI), Axis Bank and PNB revised the interest rates on.

FLOATING RATE

Below rates are applicable from 25-10-2020

| Credit score (any loan amount) | Loan Against Commercial Property | Loan Against Residential Property (LAP) | Loan against Plot/ Loan against Special Property* (Residential/Commercial) |

|---|---|---|---|

| less than zero | 10.15% – 10.65% | 10.15% – 10.65% | 10.50% – 11.00% |

| upto 650 | 10.15% – 10.65% | 10.15% – 10.65% | 10.50% – 11.00% |

| > 650 to < 700 | 9.95% -10.45% | 9.95% -10.45% | 10.50% – 11.00% |

| > 700 to < 750 | 9.80% – 10.30% | 9.80% – 10.30% | 10.50% – 11.00% |

| > 750 to < 800 | 9.75% – 10.25% | 9.75% – 10.25% | 10.50% – 11.00% |

| >= 800 | 9.50% – 10.00% | 9.50% – 10.00% | 10.50% – 11.00% |

*Special property is defined as Educational Institutes/Hotels/Schools/Hospitals/Industrial sheds.

Pnb Interest Rates On Fixed Deposits

* The above rates of interest are subject to change at the sole discretion of PNB Housing

PNB Housing offers floating rate of interest, linked to its benchmark rate PNBHFR

PNBHFR for existing customers (loan disbursed) before 1st March 2017: 14.57% p.a.

PNBHFR Series 0 for existing customers (loan disbursed) between 1st March 2017 – 30th June 2018 : 10.15% p.a.

PNBHFR Series 1 for new customers (loan disbursed) acquired on and after 1st July 2018 : 10.00% p.a.

PNBHFR Series 2 for new customers (loan disbursed) acquired on and after 6th March 2019 : 9.90% p.a.

PNBHFR Series 3 for new customers (loan disbursed) acquired on and after 01st June 2019 : 9.55% p.a.

PNBHFR Series 4 for new customers (loan disbursed) acquired on and after 16th March 2020 : 9.50% p.a.

PNBHFR Base Rate 2020 for new customers (loan disbursed) acquired on and after 25th September 2020 : 11% p.a.

| PNB Housing Loan |

The facility can be utilized for any of the following purposes:

|

| PNB Auto Loan |

The facility can be utilized for purchase of brand new or second hand cars. Maximum loanable amount shall be as follows:

|

| PNB Housing Loan |

The facility can be utilized for any of the following purposes:

|

Pnb Interest Rates On Loans

| PNB Auto Loan |

The facility can be utilized for purchase of brand new or second hand cars. Maximum loanable amount shall be as follows:

|