Pay In Cheque Online Santander

The cheque is in date; The cheque has been signed and dated; The cheque has both the words and figures on the front of the cheque and that these match; That both the sort code and account number is included on the back of the cheque on the right hand side (we will pay the cheque to the account confirmed on the back of the cheque). Paying a cheque in online: how to a pay a cheque in through mobile banking or the Post Office - and if banks are open Rhona Shennan. When time is of the essence, Santander Consumer USA accepts payment through CheckFreePay, the largest processor of walk-in bill payments in the United States. The service enables customers to walk into any one of nearly 25,000 retail locations nationwide to make their monthly car payment the same day (depending on when payment is made), next.

- Pay Cheque Meaning

- Pay In Cheque Online Santander Internet Banking

- Pay In Cheque Online Santander Bank

- Pay In Cheque Online Santander Account

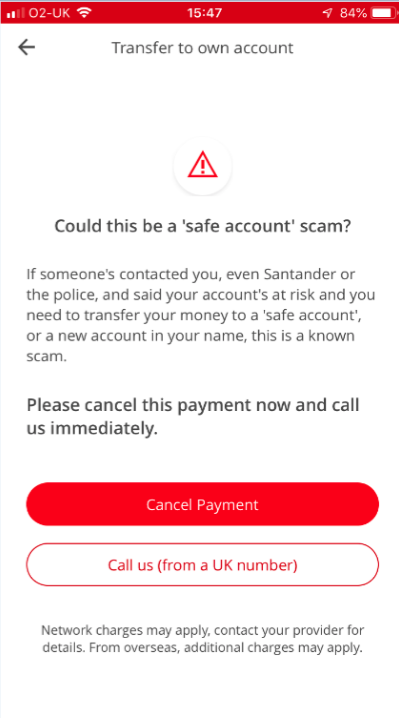

Keeping you safe from scams

We want to do everything we can to make sure that you’re safe from scams when you make a new payment.

We’ve worked with other UK banks and the regulators to make changes recently to the steps you need to make when you make new payments. The reason for these changes is to help you be as sure as you can be that your money goes to the right place.

For a step-by-step guide on how to pay or transfer money online, please visit our page on payments and transfers

When you make a payment to an individual or business you haven’t paid before, or change the account details of one you have, (including the account number and sort code) you’ll need:

- The account name exactly as it appears on their bank account statement or invoice if you’re paying a business

- The account type - personal or business

We’ll check the details you provide against the details on the payee’s account and let you know the results before you make the payment. There can be a few outcomes:

1. The name and account type match

If you use the right name and account type, we’ll let you know that they match the account you’re trying to pay, so you can carry on with the payment. No payments will be made automatically. Even when the name and account type match, you’ll always need to confirm that you want to go ahead.

2. The details partially match

If you’ve got a partial match, you’ll be given the actual name or account type of the account holder, so you can check and update the details, or contact the person or organisation you’re trying to pay.

3. The name doesn’t match

If the name doesn’t match, we'll tell you, and ask you to contact the person or organisation you’re trying to pay.

4. We can’t check the account

If the type of account doesn’t support the checks or there’s a technical issue we’ll tell you. Not all banks are participating in the scheme straight away so if you’re paying someone whose bank isn’t participating just yet we won’t be able to check the name on the account you’re sending money to.

If we can’t check the account details, you’ll be able to use the details you have if you want to, but you should always double-check they’re correct. The funds may go to the wrong account and we might not be able to recover the money.

If you need to pay a joint account you’ll need to ask for the name of one of the joint account holders, exactly as appears on their account statement.

You'll need to provide the business or trading name exactly as it appears on an invoice or other payment instruction you've been given. (Remember that some businesses may have more than one trading name).

These checks can help you avoid simple mistakes like mis-typing account details when you set up a payment. They also help tackle some types of fraud like authorised push payment scams and other forms of maliciously misdirected payments. Find out more about spotting fraud or scams

We’ll be checking Faster Payments, standing orders and CHAPS. International transfers, credit cards and BACS payments. Direct Debits – aren’t included for the time being and this feature won’t be available for cheque payments.

Customers of participating banks will automatically be included so that we can make these checks to help our customers pay the right account. However, if you’d rather opt out, you can let us know and we’ll make sure that your name won’t be validated and presented back to anyone sending you payments. If you’d like to discuss opting out, or understand the implications, please contact us

Pay Cheque Meaning

Never set up new or change existing payment details without first verifying the request directly with the person or company you're paying, preferably using existing contact details.

You’ll already be familiar with changes we made a while ago:

Pay In Cheque Online Santander Internet Banking

- When you enter the sort code of the account you’re paying, we show you the name of the bank so that you can check it’s the right bank.

- We ask you to choose a reason for the payment so that we can help protect you from scams.

- Before you go ahead with a payment we ask you to make sure all the information is correct and that you’ve read the messages we’ve shown you.

Pay In Cheque Online Santander Bank

Never set up new or change existing payment details without first verifying the request directly with the person or company you’re paying, preferably using existing contact details.

Pay In Cheque Online Santander Account

- Day-to-day banking

Day-to-day banking

Our day-to-day banking services cover everything you need to run your company finances, from accepting credit card payments to paying your bills.

- Finance

- Structured finance

- Specialised finance

Finance

At Santander, we understand that to expand your operation you need access to finance. Here you’ll find a range of options suited to short and long-term needs.

- International trade

International

We’re focused on bringing a fresh perspective to businesses with ambitions to grow beyond traditional markets.

Our extensive local networks and knowledge around the world means we’re ideally placed to support your international trade plans. Let us help you uncover the path to international success.

- Sectors expertise

Sector expertise

Our sector specialists are here to help you prosper.

We understand the complexity and evolving needs of businesses in a wide range of industries. Our experts will work with you to help turn your aspirations into reality.

- Insights & events

Insight & events

Read the latest Santander news, market developments and insights, as well as register your interest to attend our events held across the UK.