Minimum Deposit

In this day and age, you would think that CA$1 can’t buy you much but that’s not the case with Minimum Deposit Casinos. There is no longer the need to pay top dollar to have access to the best online casino games. You can sign up today and start playing for as little as 1 Canadian dollar (CA$1). Minimum deposit casinos allow Canadian players to get a feel for a casino, grow their bankroll all while having some fun at a Canadian online casino.

The advantages of playing low – stakes and depositing the minimum amount at Online Canadian Casinos are quite easy to see. When playing at minimum deposits casinos, players who enjoy online casino games are able to extend their fun, save on their bankroll and still stand a chance to win some prize money.

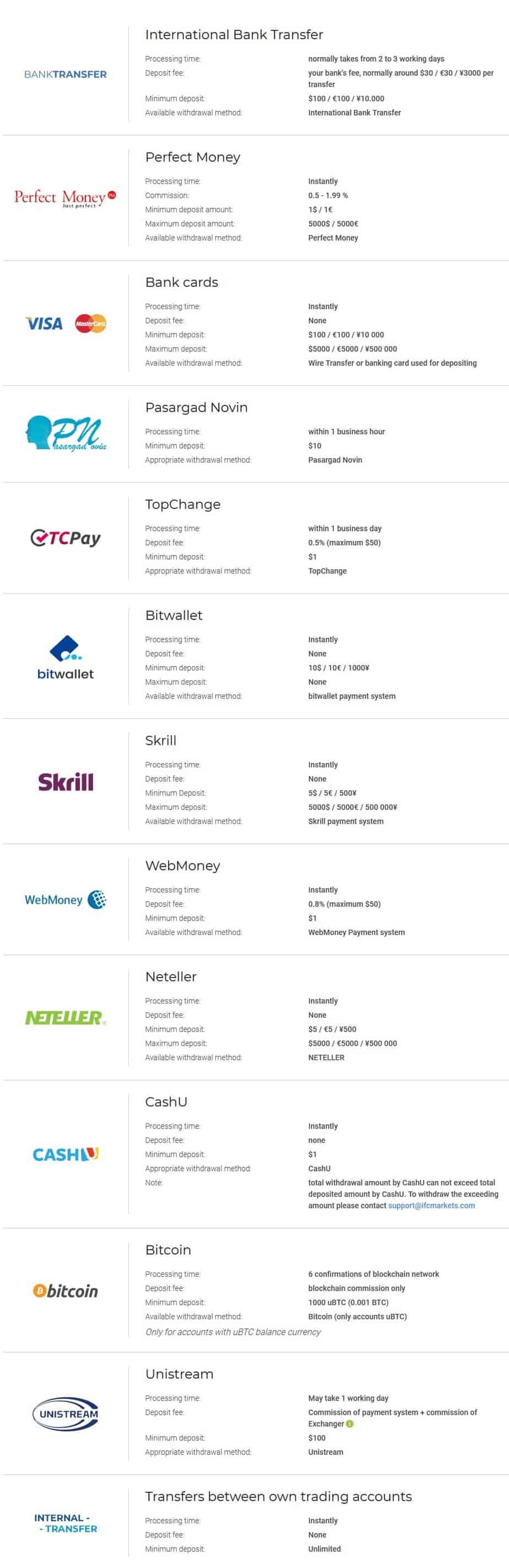

Beyond the official minimum deposits of $1, $5, $10, and $20 that you’ll find at casinos, there is another kind of casino in Canada that players covet. These are the casinos where no deposit is required at all. This is not often heard about because it is quite rare. IC Markets minimum deposit is a condition that allows the user to deposit money into his account and start trading with a real money account. In new cases, users verify the broker’s assurance with a minimum deposit. With IC Market, the minimum deposit is a condition only, in which case no injustice is imposed on the customers. The trader must make an OctaFX minimum deposit of at least 50EUR or 50USD. If they do this, they will be credited with a bonus equal to 50% of the deposited amount. This bonus is subject to certain conditions and cannot be withdrawn right away. In order to satisfy these conditions, you will have to trade a certain number of lots.

There is an FXTM minimum deposit amount of 5 USD, EUR, or GBP; 20 PLN, 400 INR, or 1000 NGN and a commission of 3.9%. The processing time for this deposit method is 2 hours within Europe and instant for the rest of the world. Even online casinos that offer a very low minimum deposit such as a $1 minimum deposit, $5 minimum deposit or a $10 minimum deposit will generally offer a welcome bonus. What you need to understand is that the welcome bonus usually has specific terms and conditions. One of those terms could include a minimum deposit to qualify for the welcome.

We aim to help you pick the top Canadian minimum deposit casinos by comparing factors like payment methods, bonuses, security and fairness and then share these findings with you in our top Canadian Minimum Deposit Casino list.

Canadian Toplist of $1 Casinos

| Casino | Offer | Min Dep | Rating | Sign Up |

|---|---|---|---|---|

Jackpot City | Deposit CA$1 get 80 Free Spins * | 90% | ||

Spin Casino | Match deposit up to $1000 * | 96% | ||

Lucky Nugget | 150% match up to $100 * | 93% | ||

All Slots | Get a $1500 Bonus * | 93% | ||

22Bet | $300 - 100% Match Bonus + 22 points * * | 98% | ||

Woo Casino | 100% match bonus up to $/€200 * | 93% | ||

Gaming Club | $350 - 100% Match Bonus * | 91% | ||

| *T&Cs apply to each of the offers. Click “Sign Up” for more details. Please gamble responsibly! You must be 18+. | ||||

Benefits of Trading with small Amounts and list of forex brokers with a low minimum deposit

While we would all love to have tons of money in our trading accounts, starting out with a small deposit is highly recommended to ensure you do not blow up your life savings. Trading with small amounts helps you hone your skills and prevent you from blowing up your account in the future. Other than the skill building aspect, there are also other advantages that come with trading with small amounts, including;

- Experience

Experience is an important factor to consider when trading forex. Trading with small amounts allows you to gain experience while minimizing your losses. Once you have acquired enough experience, you can then proceed to use larger amounts to trade.

- Experimentation

Trading small amounts is not just useful for novice traders. An experienced trader may also trade with small amounts when they want to try out a new trading strategy.

- Reduce Commissions

When trading small amounts, you are usually constricted to put the majority of your money into a single trade. This, however, helps you reduce commissions. Traders are usually more likely to be sloppy when you are going to be making 20 trades in a day. But when trading with small amounts forces traders to be more selective about the trades they take.

These traders are sure to take their time to find and trade with only the cleanest charts, with the best risk to reward. This also means they will be focusing more on perfecting their strategies as to being a jack of all trades and a master of none.

- Better Management of Risk

When trading with a huge account, most traders usually end up using fuzzy math when evaluating risk, reward or prospective trades. This is because they are making many trades and the difference between a good risk and an almost acceptable one feels irrelevant. However, when you are trading with a small amount, you do not get room to fool around.

Minimum Deposit

With a small amount, you are usually putting in all of your capital in a single trade. Hence, if you suffer a loss, it will have a significant impact on your account as a whole. Also, when dealing with a small account, your goal is towards a specific goal which is growing your accounts enough to be able to hold multiple positions at a go. Hence, any loss, no matter how small, feels like a real setback.

- Lose less money

As a beginner trader, it is not unlikely that you will probably blow out your first account. Therefore, if you start with a small account, you will lose less, making it a smart business decision.

- Focus

The trading market has a lot of information circulating every minute. This can become overwhelming, especially for a new trader who is watching a huge number of stocks, listening to the news, and trying to manage their position. This, in turn, can lead them into making bad trades, not trading anything or even having a breakdown.

One of the benefits of trading with small amounts is that you will only be managing one trade at a time. This helps remove a massive amount of stress, allowing you to focus on that particular trade. As a result, you grow accustomed to managing the stress and data of trading, allowing you to slowly increase your ability to manage more concurrent positions.

List of Forex Brokers with a low minimum deposits 2021

| Broker | Info | Bonus | Open Account |

|---|---|---|---|

| Min Deposit: $5 Spread: From 0.2 Pips Leverage: 500:1 Regulation: FSA (Saint Vincent and the Grenadines), CySEC | 50% Deposit Bonus, Real contest 1st prize Luxury car BMW X5 M, Copy trading, Trade&Win. | ||

| Min Deposit: $1 Spread: From 0 Pips Leverage: 3000:1 Regulation: CySEC, IFSC | $100 No-Deposit Bonus, 100% Deposit Bonus | ||

| Min Deposit: $5 Spread: From 0 Pips Leverage: 888:1 “*This leverage does not apply to all the entities of XM group.” Regulation: ASIC, CySEC, IFSC Belize | “50% +20% deposit bonus up to $5,000, Loyalty Program Bonus “*Clients registered under the EU regulated entity of the Group are not eligible for the bonus and the Loyalty Program” | ||

| Min Deposit: $1 Spread: From 0 Pips Leverage: 2000:1 Regulation: FCA UK, CySEC, FSP, BaFin, CRFIN | 35% of the account Deposit | ||

| Min Deposit: $1 Spread: Fixed Spread From 3 Pips Leverage: Up to 1:1000 Regulation: CBR, CySEC and FFMS | 30% Forex Deposit bonus |

When you are just starting out trading, we highly recommend that you seek the services of reputable brokers. While low minimum deposit forex brokers seem attractive, you should be aware that many in the market are scammers. So make sure you trade with a regulated fx broker with a license. Here are our top 5 forex brokers with a low minimum deposit:

- Financial Brokerage Services (FBS)

FBS is a predominantly Asian forex broker with offices in China, Philippines, Malaysia, Jordan, Russia, and Vietnam. FBS brokers are popular amongst traders for their low barrier to enter the markets. To open an account with FBS, you need a minimum of $1 to open an FBS Account. They offer two types of accounts for smaller traders, including:

Minimum Deposit For Etrade

• Cent Account: This account starts at $1 deposit

• Micro accounts: This account starts at $5 deposit

- Instant Forex Trading (InstaForex)

InstaForex is a Russia-based forex broker that has been offering trading services since 2007. This broker is regulated by FSC in the British Virgin Islands and CySEC in Cyprus. InstaForex provides two options of account types;

• Demo accounts: this account allows traders to test the platform without risking any money.

• Standard account: this account has a minimum deposit requirement of $1.

- XM Forex

XM is one of the leading forex brokers with small trading amounts, spreads as low as 0 pips and over a thousand financial instruments for trading. XM is regulated by FCA, ASIC, and CySec. This broker offers minimum deposits of $5 for anyone looking to open an account with them. XM Forex Allows new traders to enter the market with relatively small amounts

- OCTAFX

Founded in 2011, OCTAFX offers reliable trading conditions to provide traders of all skill levels with an opportunity to learn while trading. They offer traders a minimum deposit of $5 to open a Micro account. What this means is that traders, both new and old no longer feel deprived because of short balances or lack of access to the global currency exchange markets. This broker is regulated by FCA.

- EXNESS

Exness is an international award winning retail fx broker that was founded in 2008. This broker is regulated by FCA and CySEC.Clients of the Exness fx brokers enjoy excellent trading conditions, including flexible leverage, tight spreads, instant withdrawals of profits, low minimum account requirement and 24/87 customer service.

They offer minimum deposit accounts of $1 with low spreads for the Cent and Mini accounts. The mini account is designed for beginners in the FX market, allowing them to gain trading experience while minimizing losses.

- Henyep Capital Markets (HYCM)

Based in London, UK, HYCM is a forex broker licensed and regulated by the Financial Conduct Authority (FCA). HYCM offers three different types of account to suit the needs of various traders. It offers a Micro Account, which is recommended for beginners, It offers a low initial deposit of just $100

Trading conservatively with small amounts is a smart move for beginner traders. By investing small amounts, these traders not only gain experience in the real trading market, but you do this while protecting yourself from big financial losses. Once you have had enough experience and even developed a trading strategy, you can then go trade with bigger amounts.