Keybank Cd Rates

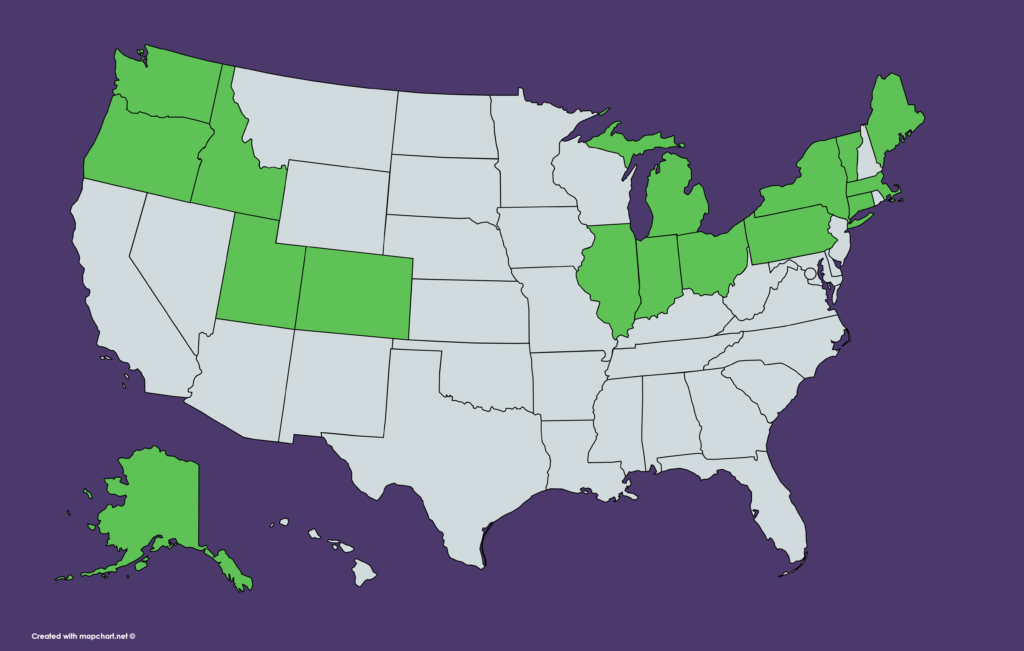

KeyBank is a mid-sized, regional bank that operates both online and offline. They can take consumer deposits from residents in all 50 states, however, their branch and ATM network are only in 25 states plus Washington D.C.

A CD (certificate of deposit) is a type of deposit account that’s payable at the end of a specified amount of time (referred to as the term). CDs generally pay a fixed rate of interest and can offer a higher interest rate than other types of deposit accounts, depending on the market. The best time to start saving is now. A certificate of deposit is a type of savings account that guarantees a certain rate of interest. Compare CD rates and select from a variety of available terms and amounts to match your short-term or long-term goals. A KeyBank Certificate of Deposit can help fast track your path to financial wellness. Bank CD rates compare to top-yielding banks Compared to other banks, U.S. Bank’s CD rates leave a lot to be desired. You can currently find competitors paying around 0.65 percent APY on. Certificates of Deposit are one of the safest and most convenient ways to invest. To open a CD bank account, get in touch with Kearny Bank today. You must first have or open a checking account and enroll in KeyBank Relationship Rewards. Clients with Key Advantage Checking, Key Privilege Checking, or Key Privilege Select Checking are eligible for a higher Relationship Reward APY rate. Minimum balance for the Short Term CD account is $2,500. Terms go from 7 days to less than 6 months.

KeyBank has 1,197 branches and 1,572 ATMs in the following states:

- Alaska

- Colorado

- Connecticut

- Delaware

- Florida

- Idaho

- Illinois

- Indiana

- Iowa

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- Ohio

- Oregon

- Pennsylvania

- Rhode Island

- Texas

- Utah

- Vermont

- Virginia

- Washington, D.C.

- Washington

KeyBank has a full suite of FDIC-insured deposit accounts complete with checking, money market, certificates of deposit and savings accounts. For the purpose of this review, we will focus on KeyBank’s fixed and variable rate, interest-bearing deposit products.

There are three types of CDs offered at KeyBank as well as the two money market accounts and three savings account options.

KeyBank’s Fixed Rate Deposit Accounts – The three types of CDs sold at KeyBank are:

- Key Short Term CDs,

- Key Tiered CDs and

- Key Jumbo CDs

KeyBank’s Variable Rate Deposit Accounts – The five types of variable rate savings accounts offered at KeyBank are:

- Key Active Saver

- Key Silver Money Market Savings Account

- Key Gold Money Market Savings Account

- Health Savings Account

- KEY4KIDS Savings Account

To see if these accounts are right for you, continue reading our review below.

As mentioned KeyBank has three different types of CDs to choose from. They have short term CDs with terms ranging from 7 days to less than 6 months. They have tiered CDs with terms ranging from 6 months to 10 years and jumbo CDs with terms ranging from 7 days to 10 years but requiring a minimum deposit of $100,000.

KeyBank’s short term CDs and tiered CDs come with a minimum deposit requirement of $2,500. In normal interest rate environments, higher deposit ‘tiers’ or amounts earn higher rates and APYs. Today, however, all tiers provide the same yield. For future reference, the tiers are broken down as follows:

- $2,500 – $9,999

- $10k – $24,999

- $25k – $49,999

- $50k – $99,999

- 100k or more = Jumbo CDs

We should also note that in more favorable savings rate environments, KeyBank provides better yields for those with “Relationship Rewards.” Or in other words, those who also hold a Key Advantage Checking, Key Privilege Checking, or Key Privilege Select Checking account with them. Today, however, as with their tiers, all accounts earn the same APY regardless of relationship status.

Key Bank’s Short Term CD Rates

To put the yield above in perspective, the current national average for a savings account and a 12 month CD sit at just 0.07% APY and 0.22% APY, respectively.

KeyBank’s tiered CDs come with a minimum deposit requirement of $2,500.

Key Bank’s Tiered CD Rates

As noted, in more favorable savings rate environments each CD term above would be broken down into deposit tiers with higher dollar amounts earning higher yields. Refer to the tiers listed above for a full breakdown.

If you have $100k or more, you may open a Jumbo CD with KeyBank. Currently all terms pay the same low APY as with all of KeyBank’s CDs.

KeyBank Jumbo CD Rates

KeyBank CD Interest, Early Withdrawal Fees and Grace Period

Key Bank Cd Rates 2016

All of KeyBank’s certificate of deposit accounts feature daily compounding interest for the entire term.

These CDs also automatically renew for the same term at the going APY if nothing is done during the grace period.

For all CDs with terms of 32 days or greater, KeyBank provides a standard grace period of 10 days. During this time you may add or withdraw funds penalty free. KeyBank will send you a maturity notice, but be sure to set your own reminders as well if you plan on moving funds around at the end of your CD term.

If you need access to your fund prior to maturity, KeyBank will charge you a portion of your simple interest as a penalty. The current fees are as follows:

Key Bank Early Withdrawal Penalties Short Term CDs

Key Bank Early Withdrawal Penalties Tiered CDs

Key Bank Early Withdrawal Penalties Jumbo CDs

KeyBank has three savings accounts and two money market accounts to choose from. For savings accounts, they offer a health savings account, a child savings account and a traditional savings account which they call the “Key Active Saver” account.

For money market accounts, they have a Key Silver Money Market account and a Key Gold Money Market account. The main difference between these two is the minimum daily balance you must maintain.

KeyBank Savings Accounts

* The $4 monthly service fee can be waived when you open any checking account with KeyBank.

As with their CDs, KeyBank’s savings accounts are tiered with higher balances earning more attractive rates. That said, all tiers are currently providing the same APY.

KeyBank Money Market Accounts

*KeyBank will waive the $12 monthly fee if ONE of the following requirements are met:

- Currently have or open a Key Advantage Checking, Key Privilege Checking, or Key Privilege Select Checking

- Maintain a minimum daily balance of $5000 or more during the statement cycle

- A monthly direct deposit of at least $25.00 is credited to your Key Silver Money Market Savings Account during the monthly statement cycle

- A recurring monthly online banking transfer of $25.00 or more from another KeyBank deposit account is transferred to the Key Silver Money Market Savings Account during the monthly statement cycle

**KeyBank will waive the $5 monthly fee if BOTH of the following requirements are met:

- Currently have or open a Key Advantage Checking, Key Privilege Checking, or Key Privilege Select Checking AND

- maintain a daily average balance of a $25,000 in the account

Key Bank has over 1,200 locations across 16 states, with over 1,500 ATMs. It offers a range of checking and savings accounts, including a free checking option. Some relationship products offer perks like lower loan rates and higher savings APY.

Checking Account Bonuses

KeyBank frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select cities, so make sure you read the fine print carefully.

Special Checking Account Features

All KeyBank checking accounts offer these unique features, in addition to free online banking, bill pay, and mobile deposits:

Key Bank Cd Rates Ct

- HelloWallet financial tools. This tool helps you manage your money and reach your goals. It lets you see where you spend the most money and how much budget you have left. It even lets you see the entire picture of your finances - even non-KeyBank accounts. You get a Financial Wellness score, and as you change your money habits, you'll see how your score changes.

- Overdraft protection. To help pay for overdrafts, KeyBank offers a few options. You can link a KeyBank savings or money market account, apply for a KeyBank Preferred Credit Line, link a KeyBank credit card, or link a KeyBank Home Equity Line of Credit to your checking account. If you overdraft on your checking account, KeyBank will take the funds from your linked account.

An overdraft protection transfer fee may apply (and credit line interest rates), but you'll save on overdraft or non-sufficient funds fees.

- Text banking. When you opt in to text banking, you can text specific commands to check your account balance and get history of recent transactions.

How to Avoid KeyBank Checking Account Fees

Key Bank Cd Rates Pittsburgh

- Hassle-Free Account. This is KeyBank's free checking option. This account has no service fees and no minimum balance requirements. The minimum deposit to open is $10.

- Key Express Checking. The $7 monthly service fee can be waived if you: make at least 8 transactions per month (deposits, withdrawals, transfers), OR have at least $500 in deposits per month.

- Key Advantage Checking. The $18 monthly service fee can be waived if you: maintain a combined balance of $10,000 across all deposit and investment accounts, OR have a KeyBank originated mortgage and have automatic payments of at least $500, OR are a Key@Work program member and have at least $1,000 in direct deposits per month.

- Key Privilege Checking. The $25 monthly service fee can be waived if you: maintain a combined balance of $25,000 across all deposit and investment accounts, OR have a KeyBank originated mortgage and have automatic payments of at least $500, OR are a Key@Work program member and have at least $2,500 in direct deposits per month.

- Key Privilege Select Checking. The $50 monthly service fee can be waived if you: maintain a combined balance of $100,000 across all deposit and investment accounts, OR are a Key@Work program member and have at least $5,000 in direct deposits per month.

- Key Student Checking. The $5 monthly service fee can be waived if you: make at least 5 transactions per month (deposits, withdrawals, transfers), OR have at least $200 in deposits per month.